By Abhinav Gupta, Founder at Profit Jets

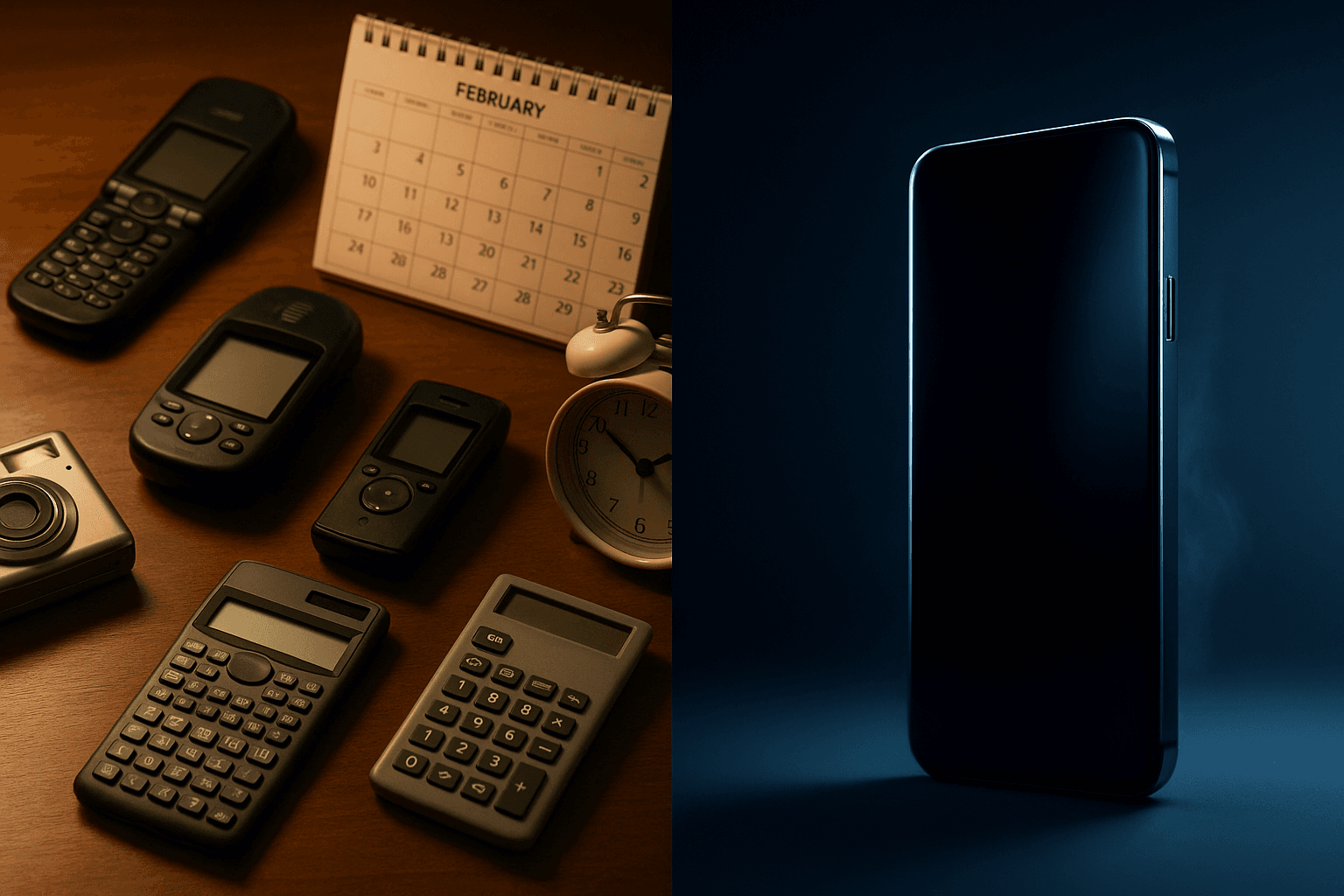

In early 2025, global EdTech funding fell to a place many founders never thought they would see again. Capital slipped back toward pre-mobile era levels. From the 2021 peak, funding dropped by almost 90 percent to around $2.4 billion. Deal volume tightened hard, even as average cheque sizes moved up.

That contrast explains 2025 better than any headline.

Capital stayed in the system. It just became far more selective. Investors stopped backing ambition on optimism and started backing clarity, predictability, and execution. For EdTech founders, this marked a reset. Growth narratives had to show up in unit economics. Vision had to hold up when mapped to cash flow.

This was the year EdTech funding became a CFO-led conversation.

Table of Contents

ToggleThe End of Growth-First Storytelling

By Q1 2025, deal counts were down by nearly 35 percent year over year. At the same time, the average cheque size went up to about $7.8 million. That gap tells you everything. Capital was available, just for far fewer companies.

The ones that raised looked different in the basics.

Burn multiples below 1.0x.

Runway of 24 to 30 months.

Clear answers on retention and repeat revenue.

Investor conversations shifted without drama. Scale stopped leading the discussion. Sustainability did. Financial discipline became table stakes. Funding decks moved past top-line ARR and straight into contribution margins, cohort behaviour, and cost efficiency.

Teams that treated finance as something to clean up later struggled to move conversations forward. Teams that broke ROI down line by line built confidence quickly. Valuations followed predictability, retention, and execution, not raw user counts.

US EdTech: Stabilisation Powered by AI and Discipline

After two painful years, US EdTech funding did not bounce back. It stabilised. Around $2.9 billion came in during 2024, and that number matters less than how the money was deployed.

Capital concentrated at the early stage. AI-native teams led because they could build, test, and ship faster with far less capital. Seed and Series A cheques grew, but only where the product already worked. Investors showed little patience for roadmaps that needed two more years to prove relevance.

What stood out more than the tech shift was the behaviour shift.

Founders made uncomfortable calls early. Down rounds and bridge raises became tools to stay alive, not ego events. Burn was cut before the bank balance forced the issue. Hiring slowed with intent. Runway planning became a weekly habit. Many founders started operating with a CFO lens long before bringing one on payroll.

Large, narrative-driven growth rounds lost favour. Smaller cheques backed teams that hit milestones predictably. Even with AI reducing build costs, capital still followed traction, pricing discipline, and early monetisation.

The US EdTech story in 2025 was clear. Investors stopped paying for adoption alone and started paying for businesses that could show, in plain numbers, how usage converts into cash and how long that cash can sustain the company.

India’s EdTech: Scale Under Scrutiny

If you step back, India is still a massive EdTech market. Around $7.5 billion in 2024. The opportunity never disappeared. What changed was the tolerance for how that opportunity was chased.

The reset was brutal. Over 2,000 EdTech startups shut down in five years. Capital walked away from models that depended only on heavy marketing and constant discounting. Reach without retention stopped working very quickly.

What is interesting is that funding did not stop completely.

Teams that were disciplined continued to raise. If you could explain your unit economics clearly, control your costs, and show how money actually comes back into the business, investors stayed interested. Subscription platforms held up. Upskilling companies with repeat revenue made sense. Hybrid models that combined offline trust with online scale started to look credible.

The conversation changed on the ground. Profitability came into focus. Loss reduction became visible. Governance stopped being a side topic.

Add regulatory pressure into the mix, and CFOs had to get involved much earlier. Compliance costs, data privacy exposure, cross-border capital implications all became part of growth planning.

At that point, market size alone stopped convincing anyone. In India’s EdTech market, survival came down to monetisation, retention, and discipline.

Investors Moved From Hype to Metrics

By late 2025, the numbers started telling a very clean story. Valuations reset, and they did so quietly.

Median EV to revenue multiples settled around 7.8x, well below the double-digit highs of the boom years. EV to funding ratios sat closer to 3.8x. In simple terms, capital started rewarding companies that could actually turn funding into enterprise value.

Recurring revenue businesses pulled ahead. B2B learning platforms, learning infrastructure, and enterprise-focused EdTech held their ground. Consumer models with high acquisition costs struggled to justify their numbers.

Investors began treating EdTech like software, not a special category.

Defensibility mattered. Retention mattered. Predictability mattered.

Funding conversations started feeling like diligence calls much earlier in the process. Financial hygiene, clean documentation, and revenue clarity carried as much weight as the product story itself. Many rounds slowed or stalled because data rooms were incomplete, revenue recognition was unclear, or reporting lacked structure, not because the vision was weak.

Governance and Compliance Became Growth Enablers

One of the clearest lessons from 2025 was how quickly confidence falls apart when governance slips. It rarely shows up as one big issue. Small gaps start surfacing, questions keep coming, and trust drains out faster than expected.

What used to live on a checklist moved straight into the middle of funding conversations. Data privacy, cybersecurity, financial controls, compliance. These started deciding how deals moved. Diligence became ongoing. Investors expected companies to be ready at any point, not just when a fundraise kicked off.

EdTech felt this pressure more than most. Student data raised the bar. Accounting systems had to grow up early. Cap tables had to be clean. Foreign capital meant regulatory clarity could not be postponed.

In India, governance failures at large companies shifted investor behaviour across the board. Caution became the starting point. CFOs ended up owning trust in the room. Companies with independent directors or strong advisory boards found conversations moved faster and closed cleaner.

The message across markets stayed consistent. Surprises slow deals. Clarity moves them forward.

Cap Tables and Cash Became Strategic Weapons

Founder ownership started getting real attention. Investors wanted to see founders still meaningfully invested, usually 65 to 80 percent by the first priced round. Heavy dilution raised uncomfortable questions around planning and decision-making.

SAFEs and convertible notes stopped being ignored. Dead equity became hard to justify. Cleanup clauses showed up more often, and suddenly cap tables were shaping valuation conversations, not just legal ones.

Cash management shifted just as clearly. Spending was planned around milestones rather than hope. Burn moved into regular board discussions. Founders began asking what happens if growth slows, not only if it accelerates.

The strongest teams aimed for burn multiples below 1.0x, raised smaller bridge rounds, delayed hiring, and protected runway. Companies that tied growth to real cash stayed in control. Others were pushed into painful resets.

What 2025 Taught EdTech Founders

The past year made a few things very clear for early-stage founders.

Unit economics drive valuation

CAC, LTV, churn, and payback periods decide credibility. Growth loses meaning without contribution margins behind it.

Runway buys leverage

Raising for 24 to 30 months changes the tone of every conversation. Short runways put founders on the back foot.

Clean cap tables close faster

Simple structures, resolved instruments, and aligned incentives remove friction before it shows up.

Governance builds confidence

Transparent reporting, audits, and compliance reduce diligence risk and move deals forward faster.

Resilient segments attract capital

Personalisation-led learning, workforce upskilling, and enterprise education continue to hold investor interest.

Burn discipline protects ownership

Iterative budgeting and ROI-led spending preserve equity and keep options open.

Above all, founders learned to speak CFO.

The Bigger Shift

2025 changed the way EdTech shows up in front of capital.

Vision and innovation still get attention, but they no longer carry the room. The story now has to survive the spreadsheet. Founders who turn ambition into financial clarity build trust quickly. Those who avoid the numbers feel conversations stall.

As 2026 comes into view, capital is cautious but very much active. It is looking for teams that pair strong products with financial discipline.

In this cycle, clarity builds trust. And trust is where capital moves.

Editor’s note: This article is a guest contribution by Abhinav Gupta, Founder of Profit Jets. The views expressed are the author’s own and do not necessarily reflect the views of Industry Examiner or its editors. Guest contributions may be edited for clarity, style, and length.